Creating a budget is one area that many people struggle with. It can be overwhelming and for many people, the scary part is being honest with yourself about your spending habits and reining them in for your future financial success.

Creating a budget doesn’t have to be scary! Here are some tips to help you learn how to create a budget that works for you.

For a simple “keep it all together” system, grab my free Household Binder here.

How to Create a Budget That Works For You

Creating a budget can be as detailed or as simplistic as you need it to be. You can cater it to your lifestyle, needs, and expenses. You may choose to use ledger paper (found at office supply stores) or software (such as Microsoft Excel spreadsheets) in your development. The goal should be to use the same method month after month…so make sure to have a good way to store it (whether a binder, a flash drive, or in an expanding organizer). Click here to see which one I use — Target usually has these in their dollar section.

Myself, personally, I use a very simple budget because I really don’t spend all that much, so whatever is left over after bills, I squirrel away to savings each month.

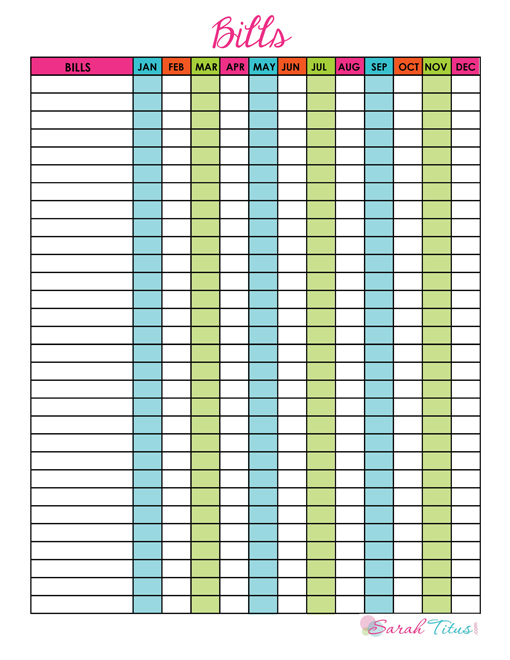

Step 1: I start by writing down each bill I have and the estimated amount they are each month.

Step 2: I write down the due date.

Step 3: Each month, as the bills come in, I put them in my expanding file and I pay all my bills once a month before all the due dates. As I pay my bills, I will write on the actual bill, the date I paid, circle the amount I paid and file it away.

Step 4: I then shade in the box under the appropriate month on the above bill payment tracker signifying that it is paid.

This really helps because some months, bills will go missing in the mail and I can easily see which ones haven’t been paid at a glance. I write in the total of all my bills on the last line, so that I know how much I need to make every month in order to cover all my bills.

When I need to add a bill, I simply add it on the sheet and X out the boxes until the appropriate month. A few months ago, I started up a medical insurance plan so I added in that payment.

One of my bills charges every 2 months, instead of every month, so on the months I don’t have that bill, I also X out the square, so I know what to expect for the month.

I really love this system because there’s not a bunch of paperwork to keep track of. It’s just ONE sheet of paper (saving me ink) for the ENTIRE year! I have a storage box (here’s the one I use on Amazon) where I keep all my receipts and bills for 3 months at a time, so I can easily just toss them all in there.

Then the storage box that is 6 months old gets shredded and I start a new box every 3 months, so I’m always rotating the two boxes. This seems to be the simplest way for me to keep track of something. Most stores have receipts on file in their computer system, so I rarely ever look for a receipt or a bill, but if I need it, it is there.

Perhaps this particular system does not work for you.

No problem. Here’s another system with a bill tracking sheet I created for you.

Maybe you’d like more of a ledger type bill system…

If so, here’s another printable I created for you.

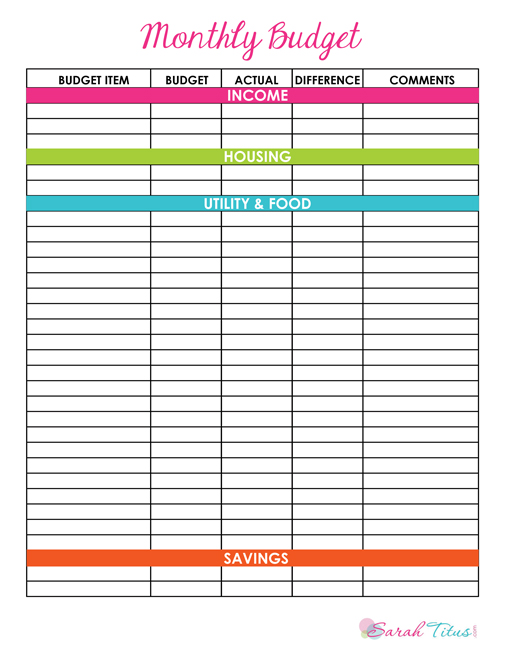

Click here to get the free printable PDF, Monthly Budget.

This budget system is very easy to use as well.

Step 1: Start by making a list of all your essential expenses that don’t change month to month. These include things like housing, utilities, credit card, and loan payments, car payments, and insurance.

These are basic expenses you have that don’t have much wiggle-room and need to be paid each month. Look at your spending habits over several months in these categories.

Looking back at your check registers or bank statements will help you to determine how much you have spent.

Step 2: Next, find the average amount you’ve spent in each category. For example, if over the past three months you’ve spent $100, $125 and $150 on utilities, then your average utility cost would be $125.

To determine the amount you should budget for that area, round up slightly, knowing that your costs will sometimes be more than you expect. I’d round up to $150/month in this case. Better to have more set aside for a bill than not enough!

Step 3: List expenses that are important, but can be adjusted with changes in your habits. These are things like groceries, gas for your car, entertainment and so on. While these items need to be included in your budget, they are also items that can be flexible during leaner months if need be.

Keeping track of how much you spend in each of these areas on a monthly basis will help you to identify those areas that can be cut-back if they need to be, as well as to figure out how you’re spending your hard-earned money.

Don’t forget to include savings as an expense!!!

Step 4: Many people forget this very important aspect of budgeting. Everyone needs a savings account in order to pay for emergencies. Savings also helps to pay for fun stuff like vacations and personal goals such as a down payment on a car or home.

If you are like me and don’t want any debt at all, you’ll want a savings account to pay for your entire car. Think of it as another expense and not an option. This is also a great budget item to put any additional income into, as it will build over time (often with interest) and will help you to meet your financial goals.

Step 5: After your expenses are listed, take note of your monthly income. If you have a fluctuating income amount (like I do every month) and not a fixed one, make an average of what you make each month when calculating this. Subtract your vital expenses first. (On the months that you are paid more, set some aside for the months you will get less. Super important!)

What you are left with is the money you have to spend on your secondary expenses. Be honest about these. What are your priorities when it comes to spending? Could you spend less on groceries than you are? Are you spending more on entertainment than you realized? Are there memberships or services that you aren’t using or want to cancel? Think of ways you could reduce your secondary expenses, so that you have more money to work with each month.

One aspect of budgeting that is often forgotten about is trying to prevent things that can ruin it. These include things like car repairs, unexpected medical expenses and broken appliances at home. Aside from your regular savings account, create an emergency fund for these things so when life happens, they won’t break you down.

Setting aside a small amount from each paycheck will help you to be prepared for the unexpected.

Need more income? I’ve been making money from home for 17 years now…check out my post, 10 Easiest Ways to Earn Extra Income From Home and the Top 25 Best Survey Companies.

One area that is pertinent to keeping your budget running smoothly is making sure that you pay your bills on time. A way to make sure that you are on-top of it is to give yourself a date or two each month (maybe the 1st and 15th) to check your bills and be sure that everything was paid. Double-check due dates. Often billing companies follow the same monthly schedule. Knowing which are due at the beginning or end of the month will help you to plan how you’re going to stay organized in payment.

If you find yourself overwhelmed with due dates and bills everywhere, you may want to consider signing up for paperless billing or auto-pay. These are wonderful options for busy people, but you still need to watch billing amounts to ensure that you’ve set aside enough each month to cover your expenses.

A well-designed budget will make these great options for you, so long as you have enough sitting in your checking account at the time that each of your bills comes due.

As often advised, make sure to hang onto old bills for several months (or years if you’d like). You may choose to do this through paper copies or electronically.

Having copies of bills will put you in a winning position if you ever encounter disputes of any kind. The information provided on them will also serve as a quick reference for you if you have billing questions, usage issues, etc.

As an added way to keep yourself organized, when you pay your bills, be sure to list your check or confirmation number on the bill, as well as the date that you paid. That way, if you find it again down the road, there is no question that it was paid.

Another very important aspect of budgeting is not relying on credit or loans.

Many people take out loans for education, homes, cars, and so on, so debt is often a part of life for the majority. The goal is to eventually live debt free with a budget, so start thinking of ways you can pay off your loans quicker.

Could you spend less on eating out each month and use that money to make a larger payment on credit card debt?

Just because you are required to pay a minimal amount each month on a loan or debt account does not mean that is all you should pay if possible. It is in your best interest to pay off debt as fast as possible because the longer you have a loan out, the higher the amount of interest you will ultimately pay.

Once you have created your budget and used it for a few months, go back and take a look at how it’s working.

Have you allotted enough money for each of your expenses?

Are you putting too much toward different items?

Are there any areas that you forgot to include in your budget?

Related: 20 Ways to Save Money on Your Monthly Bills

Considering goals that you may have and including them as budget topics (such as travel and home improvement) will allow you to build up for these areas gradually over time, rather than having to take a large chunk of money out of savings. Once you’ve reached a comfortable financial place for such goals, you can use the funds that you’ve built up and take that trip or start that renovation.

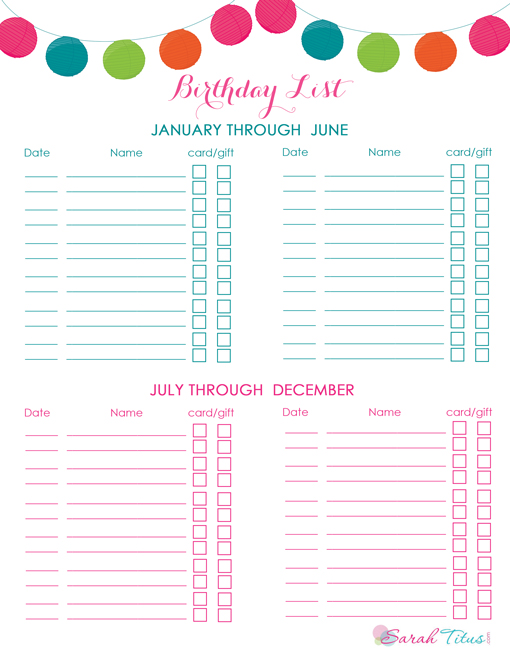

As you become more comfortable with how to work your budget, you can begin using it as a tool for other categories of expenses. You may want to consider line items for gifts, donations, date night, or holiday gifts. Each of these items is non-essential to daily living, but it is nice to have the money there to spend from time to time. Simply designating a small amount each month to some of these areas (and not spending it) will cause it to add up to a nice sum over time. This is a great way to prepare for upcoming birthdays, events, etc.

Click here to download this free birthday list planner printable.

One more benefit to building a budget (and rounding up for each of your expenses) is that over the course of the year you will likely carry money over in your budget categories. For example, if you budget $150 for utilities, you may spend $100 in a given month. You would then carry the extra $50 over in that category so that, when you use more gas or electricity later in the year, you have the money ready and waiting. A budget helps to prepare you for that cold weather or vehicle registration, so that you don’t need to figure out how you’re going to pay the bill. Your money will be there waiting for you.

Your budget can be one of the best tools you use for managing your household, but you have to remember to maintain it! Like many things, left unattended, your budget will not be helpful. You must diligently track your expenses and balance your budget against any debts you may have and bank statements.

Not keeping track of what you’re spending will only make it more difficult to keep yourself on track. Taking a look at your habits over time and making sure that where you’re spending your money reflects your priorities and goals will help you to find financial success.

Creating a budget is a great way to find financial freedom and stop living paycheck to paycheck. If you don’t have one yet, now is the time to get started! It’s practically painless and the stress it takes away is priceless!